We're in the maximizing your budget business.

MUNICIPAL LEASE

A municipal lease with GM Financial enables public entities to pay only for the useful life of vehicles. The payments under a lease program are subject to annual budgetary appropriation and are typically included as a line item in the operating budget and not considered debt. Most political subdivisions and their agencies, as defined in IRS Section 103, are eligible.

Explore Leasing Options

Dependable Vehicles that Exceed Expectations

Public entities like hospitals, city utilities, and police and fire departments depend upon transportation that can withstand the rigor of the job.

A municipal lease can help you get the vehicles your organization needs.

Contact Us

Experience the benefits

- Stretch your annual budget across multiple vehicles with low, tax-exempt rates.

- Flexible payment options: annual, semiannual, or quarterly with no processing fees.

- End-of-lease buyout option for $1.

- Lease payments treated as line items in the budget, not debt.

- Financing options for electric vehicle charging stations.

- Preserve cash flow with 100% financing and no mileage or wear-and-tear restrictions.

- Service contracts included, with municipality titled as owner at purchase.

- Master lease agreement for multi-unit purchases.

Contact an Expert

Put a Municipal Lease to Work for You

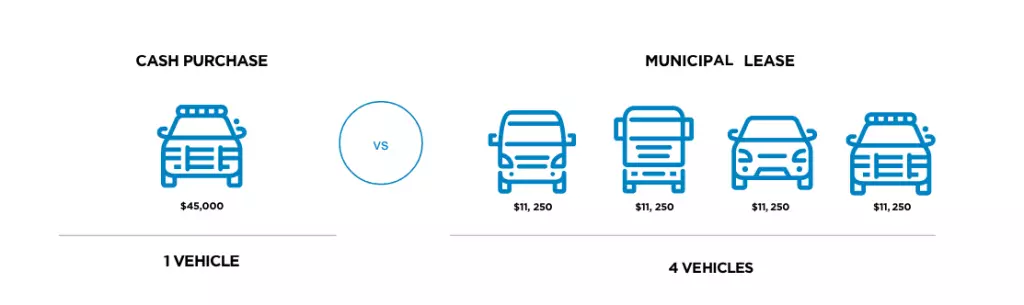

With a municipal lease, your dollars can get to work faster. For example, with a $45,000 annual budget, you could lease four vehicles for the price of purchasing only one.

Who Qualifies for Municipal Leasing?

Most governmental agencies and subdivisions, as defined in IRS Section 103, are eligible. These include:

- Cities and Towns

- EMS Departments

- Fire Departments

- Park Districts

- Police Departments

- Public Hospitals

- School Districts

- States and Counties

- Water Districts